Moreover, the concept of future value plays a significant role in retirement planning. It helps individuals determine how much they need to save today to ensure a comfortable lifestyle post-retirement. For example, a deferred variable annuity will begin making payments at a future point in time (deferred) and will also have a flexible payout rate (variable). In order to properly classify an annuity, all you need to know is when you will get paid and how that payment amount will be determined.

Future Value of a Growing Annuity (g ≠ i) and Continuous Compounding (m → ∞)

- Investors will need to wait until at least age 59 ½ or older before they can start the payout phase.

- It is possible to roll over qualified retirement plans like 401(k)s and IRAs into annuities tax-free.

- When interest growth is continuous, the payment schedule relies on a logarithmic scale.

In summary, understanding and accurately calculating the Future Value of Annuities is fundamental in financial planning. Whether it’s an Ordinary Annuity or Annuity Due, each has its unique features and applications, suitable for different financial situations. These calculations not only aid in making informed financial decisions but also in adapting to changing economic conditions and optimizing investment strategies. The significance of these concepts cannot be overstated, as they lay the groundwork for a secure and well-planned financial future.

One Month After the Rate Cut: Where Are Annuity and Other Interest Rates Now?

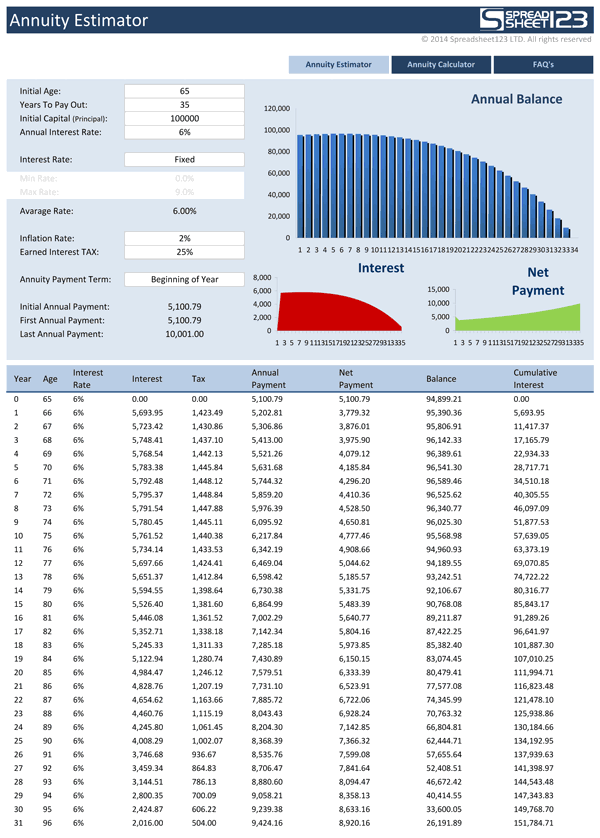

The blue line represents your annuity’s value before taxes, while the green line represents the total amount of your annuity that is taxable income. If you plan to continue contributing to your variable annuity throughout its term, you’ll enter into the calculator how much you expect to contribute each year. Additionally, you’ll tell the calculator the variable annuity’s starting balance and expected rate of return.

How To Use the Variable Annuity Calculator

Annuities can also be helpful for those seeking to diversify their retirement portfolios. The majority of annuity investments are made by investors looking to ensure that they are provided for later in life. It is important for each individual to evaluate their specific situations or consult professionals. The Set for Life instant scratch turbotax vs cpa n’ win ticket offers players a chance to win [latex]\$1,000[/latex] per week for the next [latex]25[/latex] years starting immediately upon validation. If a winner was to invest all of his money into an account earning [latex]5\%[/latex] compounded annually, how much money would he have at the end of his [latex]25[/latex]-year term?

This approach may sound straightforward, but the computation may become burdensome if the annuity covers an extended interval. Besides, other factors that need to be taken into consideration may appear and complicate the estimation even further. In the following section, you can learn how to apply our future value annuity calculator to any scenario, no matter how complex. Altogether, there are seven variables required to complete time value of money calculations.

Future Value of Growing Annuities

The calculator can tell you an estimate of what your variable annuity could be worth when you reach retirement age and start withdrawals. An ordinary annuity is a series of recurring payments that are made at the end of a period, such as payments for quarterly stock dividends. An annuity due, by contrast, is a series of recurring payments that are made at the beginning of a period. In contrast to the FV calculation, PV calculation tells you how much money would be required now to produce a series of payments in the future, again assuming a set interest rate. Aimed at the FIRE movement, this calculator helps individuals determine how much they need to save to retire early. It considers current savings, desired retirement age, expected lifestyle expenses, and other financial variables.

When the calculator is in annuity due mode, a tiny BGN appears in the upper right-hand corner of your calculator. When the calculator is in ordinary annuity mode there is nothing in the upper right-hand corner. The steps required to solve the future value of an annuity due are identical to those you use for an ordinary annuity except you use the formula for the future value of an annuity due. This calculator helps individuals determine their net worth by subtracting their liabilities from their assets, giving a snapshot of their financial health.

You can also use it to find out what is an annuity payment, period, or interest rate if other values are given. Besides, you can read about different types of annuities and get some insight into the analytical background. After that, the insurance company can change the annuity’s interest rate monthly, quarterly, semiannually or annually.